“Digital Tribes” — Consumer Segmentation with a Social Psychographic Twist

“Digital Tribes” — Consumer Segmentation with a Social Psychographic Twist

CLICK HERE TO SEE THE LIST, AND DESCRIPTIONS, OF ALL 100 OF OUR DIGITAL TRIBES.

Is your target audience a Basketball Jones or Just A Jump To The Left ? A K ulture Kween or a Mostly Marvel ?

The answer lies in our new StatSocial Digital Tribes ; a model of the US population broken down into 100 unique market segments.

StatSocial is a social media audience insights platform. Our unique technology enables us to make sense of the billions of unstructured social web interactions that go on each day — allowing you to make sense of nearly any audience you can imagine.

What we do

Social media has transformed the way consumers engage with brands. Take Twitter , as an example. There, you can keep up with HBO ’s latest hot series, share a relevant Business Insider article, and even tweet directly at Wendy ’s ( only to get roasted back ).

Understanding your social media audience unlocks a whole new level of psychographic insight, allowing you to measure consumers’ attitudes and interests.

Demographics are essential — they explain who the people that make up your consumer base are. Gender. Age. Marital status. State of residence. But, psychographics answer the why. By which we mean, why these individuals consume your product — or have a certain other affinity, or make any of a vast number of choices evident in our insights — in the first place.

Each enhances the other. Yin and yang. Demographics and psychographics . The two are complementary forces.

Let’s break it down

Traditional market segmentation

Traditional clustering models, such as PRIXM , Personicx , Mosaic , and Tapestry have paved the way for more personalized market segmentation.

These models break down audiences based on demographic, geographic, and offline consumer data. PRIZM adds a component of media habits (such as TV channels surfed and newspapers read), while Personicx highlights their socioeconomic status and financial activity classifications. Mosaic , on the other hand, is focused on delivering the operational and logistical data needed to fuel Business Intelligence ( BI ).

StatSocial: An extra layer of social behavior

StatSocial is the first in the game to integrate social activity and Personality Insights ® (powered by IBM Watson ), creating distinct segmentation models.

At StatSocial , we know whether your customers read The Atlantic, or perhaps The Weekly Standard. Do they listen to NPR , or maybe TheBlaze , or both? We know all about it. Are your customers ContraPoints people, or more about Blaire White? Are they urban-dwelling women, in their 30s and 40s, nestled comfortably within the “ Lattes, Brunch, & Subtitles ” Tribe. Are they whiling away the hours, at the most chic of cafés, keeping up with the latest tech news from Digital Trends , Engadget , and Mashable, and are therefore also members of the “ That’s a Heck of a Lot of Tech ” crowd?

We already know, and are eager to fill you in. These are not trivial tidbits for the curious, but vital and wholly actionable insights. The real-world value of knowing whether your faithful consumers are frugal, “ A Bargain Around Every Corner ” shoppers, or dwelling among the more extravagant “ Fashionista Pashionistas ” Tribe, is considerable.

We believe that online behavior is reflective of the full customer portrait. We’ve developed the math and data expertise to provide details about your audience that would have previously cost untold quantities of money, and required months upon months, or longer, of intensive surveys, focus groups, and research to obtain.

Our customer insights are gathered from over 60 social networks and every major blogging and public messaging platform. Our multi-layered taxonomies index over 370 interests, 10,000 media properties, 10,000 consumer brands, and over 30,000 celebrities and influencers.

We know your consumers down to their favorite beauty YouTube channel, their go-to camera brand, and their most beloved fast food restaurant. We know what movie genres most excite them, what apps they find most essential, and what kinds of cars they own. With the integration of IBM Watson into our unique data analytics, we also know what motivates their consumer decisions. This means we have unprecedented insight into your audience’s values, needs, and personality traits.

If our calculations reveal an overwhelming interest in a broad category (like, say, finance, tech, or music), we can dig even deeper into specifics (such as “ cryptocurrency ,” “ investments/brokerage ,” “ JavaScript ,” or the specific acts behind what our reporting indicates is an audience’s interest in “ alternative music ”).

We segment social audiences using over 50,000 defining variables — allowing us to meet your needs with acute precision.

Right place, right time

The social behavior analysis that is central to our reporting enables marketers to understand and reach their best customers through the right channels, with the right message, at the right time.

✓ We equip publishers with rich demographic and psychographic data about the visitors engaging with their content.

✓ We arm brands with the comprehensive consumer data they need to create well-rounded, individual-level customer profiles.

✓ We supply agencies with the detailed audience analyses essential to evaluating campaign effectiveness and informing decision-making.

✓ And we provide media buyers with the tools to measure online engagement with offline media in order to focus digital spending.

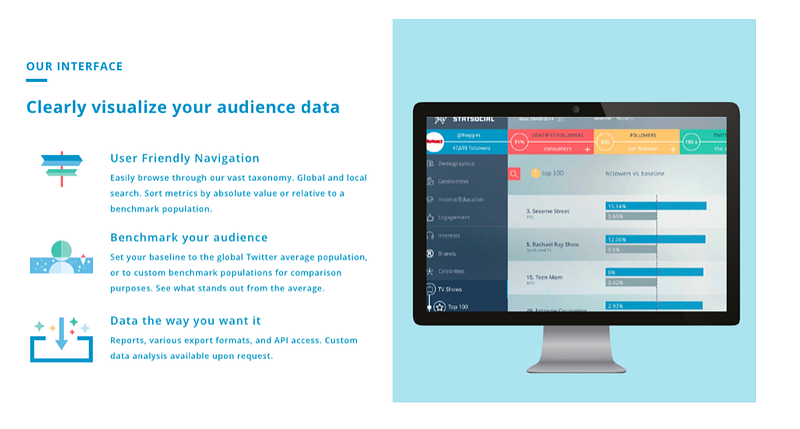

User-friendly, interactive interface

Most traditional models extract data into static, unmoving PDF files or presentations.

The interface of StatSocial ’s web platform, on the other hand, is interactive and user-friendly. Our data scientists work hard behind-the-scenes to bring you reports that are comprehensive yet easily comprehensible .

Want to see for yourself? Let’s run a sample report :

Chick-fil-A vs. Shake Shack

The below example is not a case of us sharing our tech-y backend for the sake of this entry. What you see is universal to all of our reports. Our web platform’s interface (what you see screen-capped in the graphics below) is made up of an easy-to-navigate toolbar, visuals, graphs, reader-friendly text, and indexes.

The best part? We refresh the reports at the start of every quarter.

For the First Part of this Comparison

To start, we’ll be focusing on the StatSocial Digital Tribes whose members are most prevalent among the online audiences of these celebrated chains.

There are many, many categories to be explored, and lenses through which to regard our insights. The results of a StatSocial query can number vastly beyond the small samples provided here. This all being said, we do stress that our analysis is easily navigated, and quickly compiled, compared, contrasted, calculated, and comprehended (alliteration only partially intentional).

Back to the matter at hand…

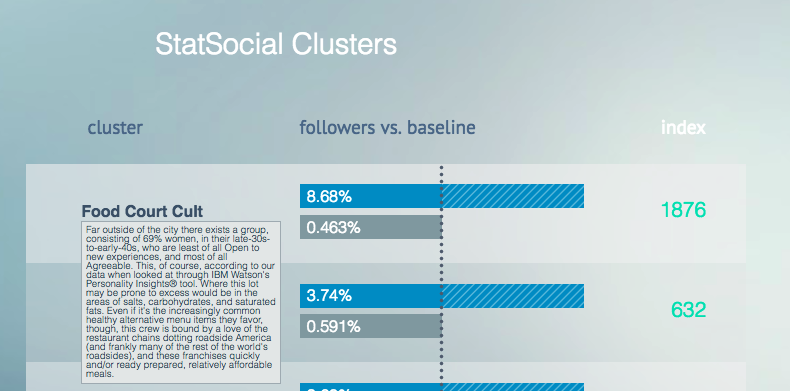

Perusing the Tribes most profoundly represented among Chick-fil-A ’s customers, we can see that members of the “ Food Court Cult ” Tribe — our fun name used to describe the Tribe made up of American chain restaurant devotees — are greatly over-indexed when measured against the baseline used here (the average U.S. online audience).

The index score of of 1876 tells us that the percentage of Chick-fil-A diners who are also “ Food Court Cult ” members exceeds the occurrence of their ilk among the greater U.S. online crowd by 18.76 times .

Hovering over a given Tribe ’s name on our web platform (as screen-capped below) provides a description of what common affinities and personalities find those consumers as part of the corresponding segment.

If you’ve trouble reading the image here, it says:

Food Court Cult:

Far outside of the city there exists a group, consisting of 69% women, in their late-30s-to-early-40s, who are least of all Open to new experiences, and most of all Agreeable (when looked at through IBM Watson’s Personality Insights® tool). This lot may be prone to excess in the areas of salts, carbohydrates, and saturated fats. Even if it’s the increasingly common healthy alternative menu items they favor, though, this crew is bound by a love of the restaurant chains dotting roadside America (and frankly many of the rest of the world’s roadsides), and these franchises’ quickly and/or ready prepared, relatively affordable meals.

As you’ll see, as you continue reading, below we compare the top-ranked brands among each collection of consumers. The presence of this Tribe’s members among the Chick-fil-A bunch is confirmed, and then some.

If we go beyond food, we get to draw relationships between different consumer markets (like, favorite consumer electronics, top TV shows, preferred news outlets, home and garden needs, and so on). Take a look around, and please read our full Chick-fil-A report .

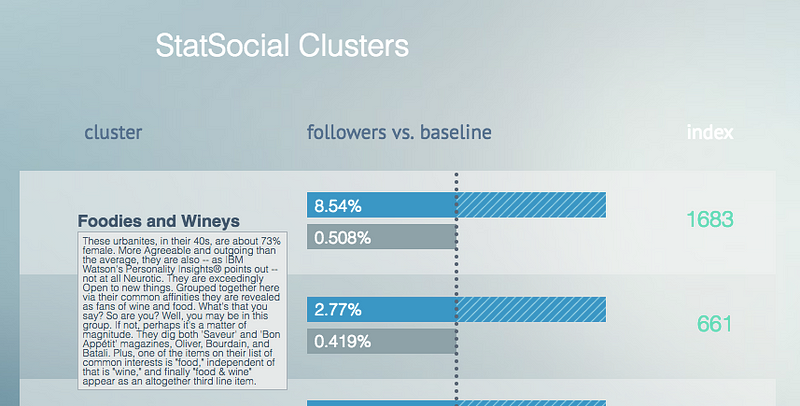

For clear contrast, we’ve run the same Digital Tribes report for Shake Shack . Members of the “ Foodies and Wineys ” Tribe are chilling amongst the Shake Shack online throngs to a degree that surpasses their occurrence among the average U.S. audience by 16.83 times .

See below:

And again, if the description — visible for all 100 Tribes , when hovering over a given T ribe ’s name on our web platform (and screen-capped above) is not legible, we provide the below.

Foodies and Wineys:

These urbanites, in their 40s, are about 73% female. More Agreeable and outgoing than the average, they are also — as IBM Watson’s Personality Insights® points out — not at all Neurotic. They are exceedingly Open to new things. Grouped together here via their common affinities they are revealed as fans of wine and food. What’s that you say? So are you? Well, you may be in this group. If not, perhaps it’s a matter of magnitude. They dig both ‘Saveur’ and ‘Bon Apetite’ magazines, Oliver, Bourdain, and Batali. Plus, one of the items on their list of common interests is “food,” independent of that is “wine,” and finally “food & wine” appear as an altogether third line item.

LET’S COMPARE THE FAVORITE BRANDS OF EACH AUDIENCE

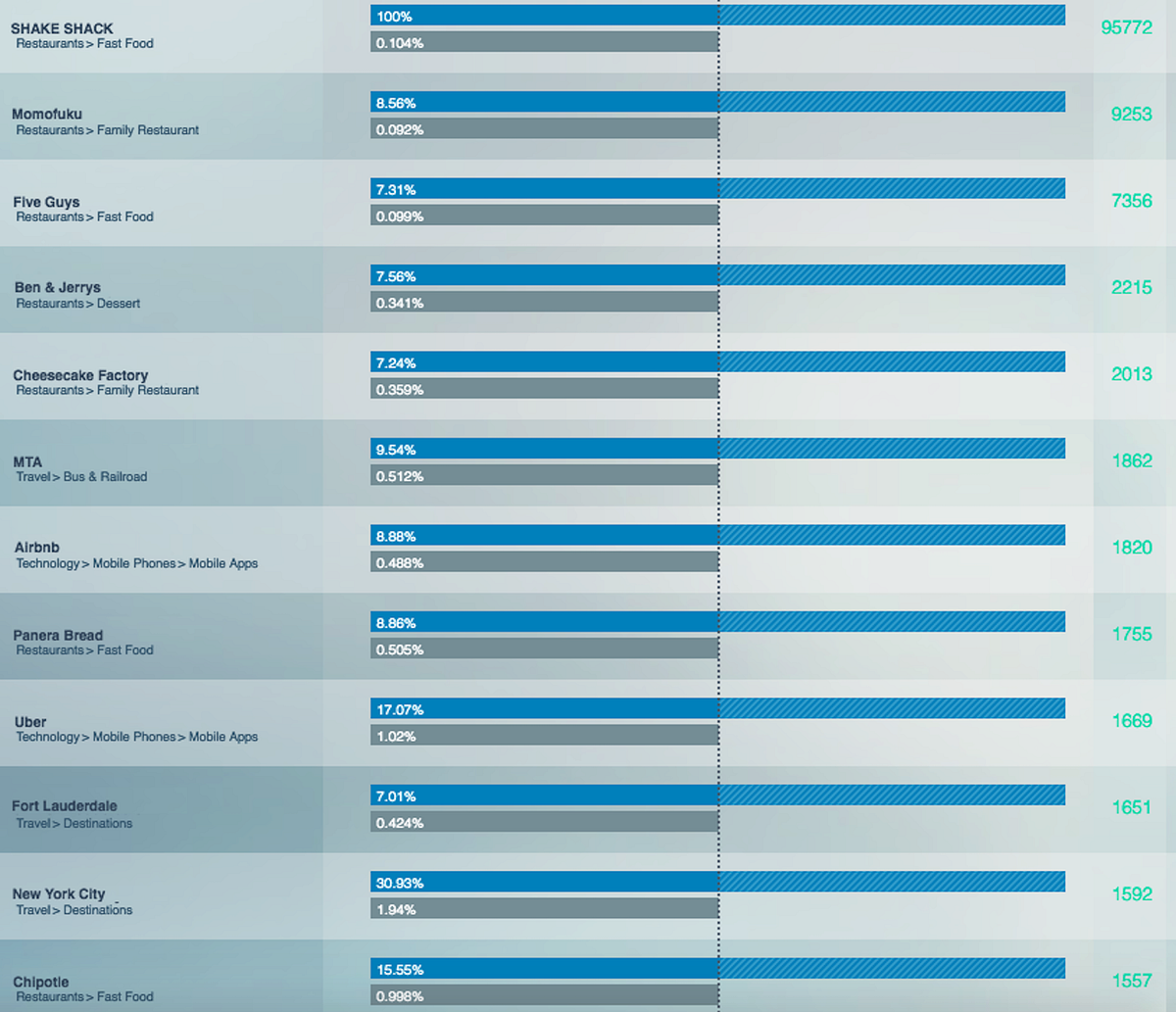

This time out, let’s start with Shake Shack …

Below you’ll see that Momofuku is the second entry on the list. A notable result for a restaurant located only in NYC, Sydney, Toronto, D.C., and Vegas. Quickly, the relationship between city-dwellers and Shake Shack eaters is more than suggested. Transportation categories are also heavily over-indexed with the celebrated burger and shake chain. We find NYC’s mass-transit providers, MTA , as well as Airbnb , and Uber , highlighted along with the popular tourist destinations of NYC and Fort Lauderdale.

A Bit of a Sidebar on What These Statistics Mean

It’s unsurprising to find that Shake Shack tops the above list, with 100% of this audience identifying as enthusiasts. More valuable, though, is discovering the other brands and interests rating highly with this consumer base.

A story is told here: Shake Shack diners are urbanites, on the go, and travelers. While only a small wrinkle in the easily assumed narrative, these epicures do love The Cheesecake Factory . A fine family restaurant chain, surely, but one whose presence slightly alters easily made assumptions about this audience.

It should be added here that analysis of no solitary set of data from StatSocial ’s reporting will either define or subvert the full picture of any given group under your microscope (our data sets, of course, also run far deeper than a mere 10 items, as shown above). We provide what one needs to consider an audience from the relevant angles. If the question is, for example, “ How cosmopolitan is this group of consumers ?” StatSocial makes readily available all the information necessary to draw an accurate, nuanced conclusion.

These insights, incidentally, do not mean that Shake Shack diners prefer restaurants and prepared foods over peer-to-peer ride-sharing apps (such as Uber ), or Floridian cities (like Fort Lauderdale ). What it means is that, in the digital sphere, these consumers are more likely to engage with, and express their excitement for, restaurants than they are for mobile apps and travel destinations.

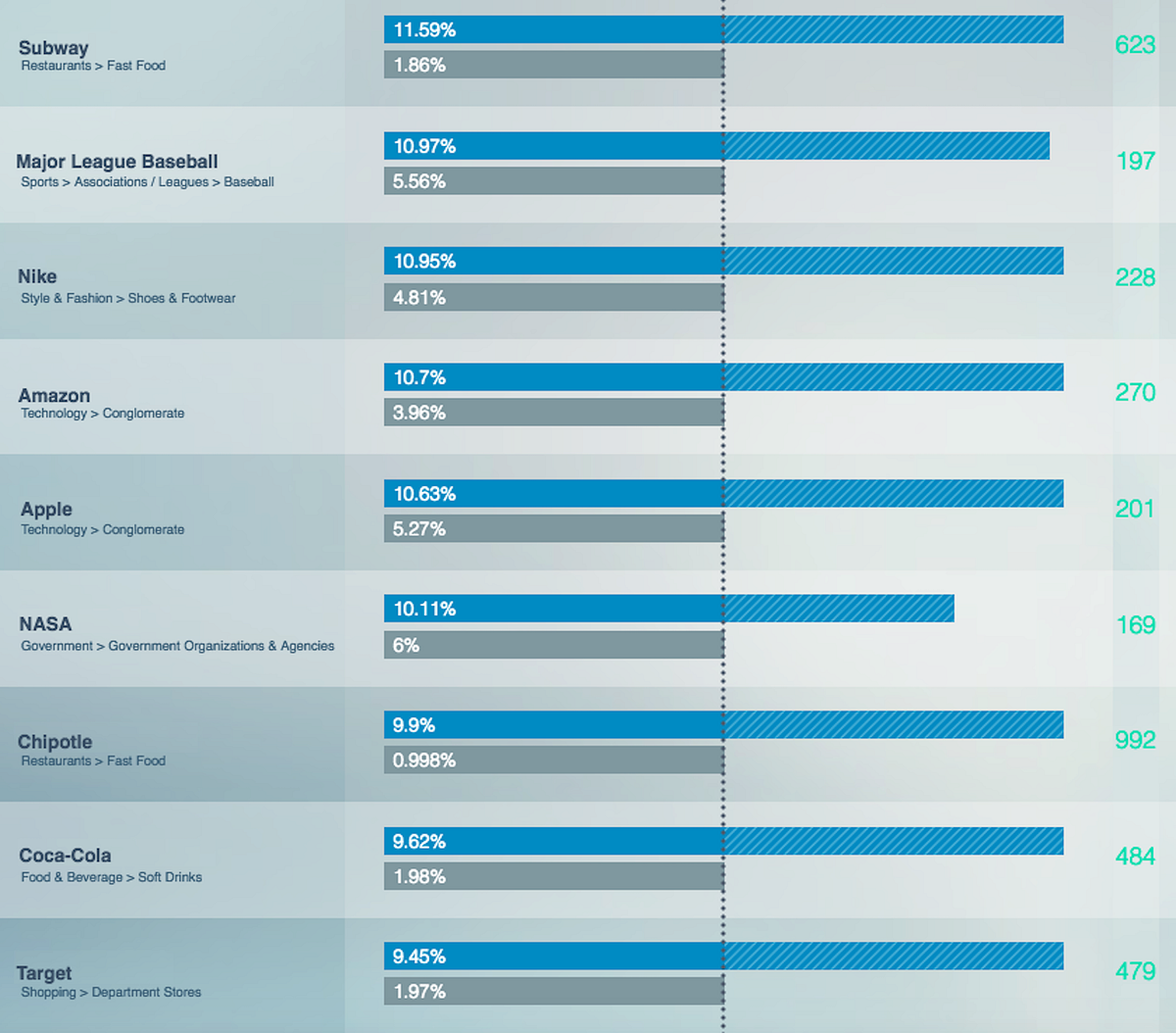

Moving On to Chick-fil-A’ s Customers’ Favorite Brands

Shake Shack ’s list stands in rather pronounced contrast with that of Chick-fil-A . The latter’s audience’s fondness for NASA indicates that they are decidedly not opposed to those things “ on the go ,” but the only subway to be found here is the sandwich chain.

In general, no connections to hustle, bustle, or those things explicitly cosmopolitan are evident here.

Before sending you on your way, to enjoy your day — a day that maybe will find you reaching out to us for a full demo of StatSocial ’s capabilities, which you can do by clicking here — we’ll show how each data set enhances, adds color, bolsters, or brings nuance to whatever assumptions one might be making about the audience they’re analyzing.

LOCATIONS

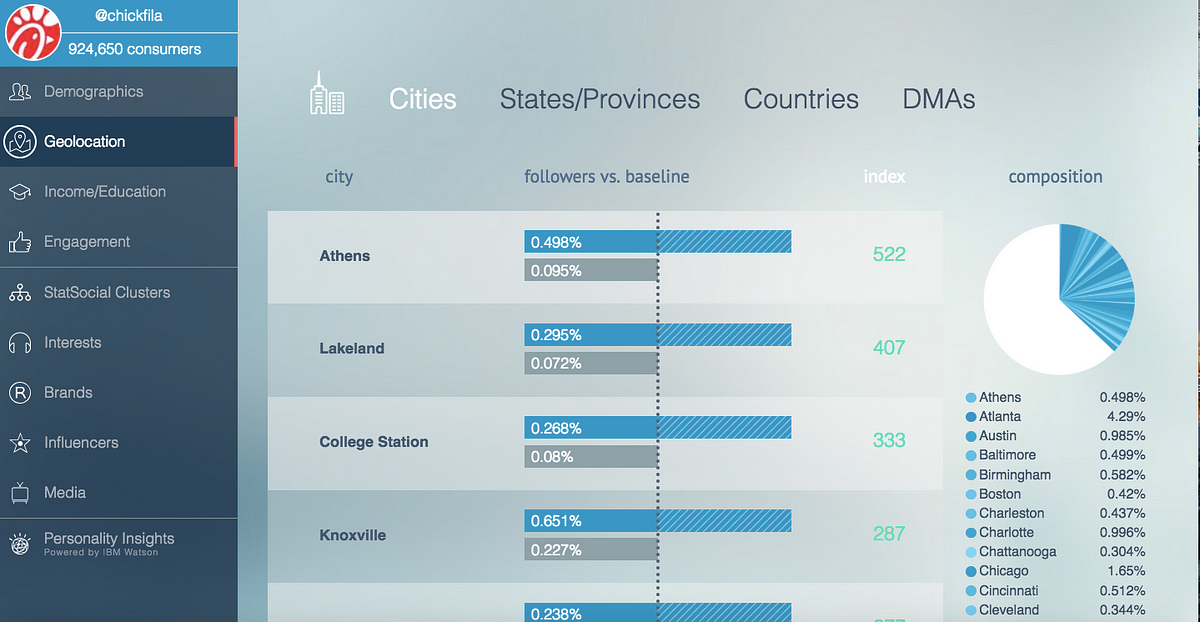

The most prominent cities of residence for Chick-fil-A ’s customers are jewels of the southland, such as Athens, Atlanta, and Knoxville, as well as Florida’s Lakeland and Tuscaloosa.

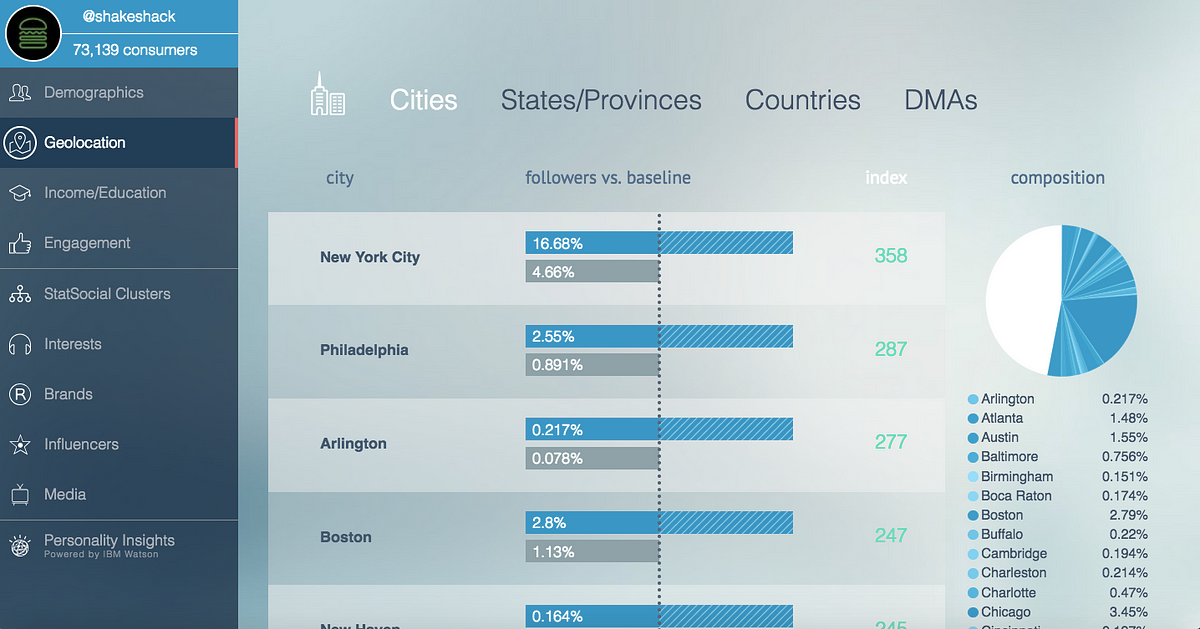

Conspicuously, we find the Shake Shack faithful favoring altogether different climes.

NYC, Philly, Boston, D.C., Miami Beach, Austin, Chicago, San Francisco… The Shake Shack- ers are more dispersed throughout the regions of this great land. The southern towns where these diners can be found tend to be noted for harboring populaces whose views tend toward the progressive.

The deeper you dig, the more you’ll know for certain who it is populating each and every group in which you’re interested. Every audience is a made up of individuals; each with different interests, affinities, quirks, and motivations, and each from different locations, generations, and backgrounds. In virtually no time at all, StatSocial unveils for you the full variety of flesh and blood people existing within every audience.

As you hopefully suspect, and we promise you is the truth either way, this is only the smallest hint of what we have to tell you about any possible online audience you can imagine.

Take a look around our blog to see many more side-by-side comparisons of competitors (and sometimes collaborators) from a variety of sectors, as well as entries focused on one particular audience. You will also find an assortment of fun and entertaining demonstrations of the many facets and applications of StatSocial ’s comprehensive, but easily managed and understood, insights.

If you’ll allow us to curate your introduction to our blog, might we recommend this explicitly Digital Tribes focused entry — looking at Taco Bell’s audience — here . For a solid side-by-side comparison, maybe check out our deep dive into the users of Salesforce and HubSpot ; the entry highlights how the detail and depth of StatSocial ’ s calculations allow our users to identify, with ease, the differences between audiences that less thorough analysis might conclude are fundamentally alike.

You are invited to also peruse some sample reports , as well as to reach out to us — or even add us — on Twitter and Facebook .

AUTHOR: Daniela Karpenos (with revisions and updates by the StatSocial team)

— — — — — — —

INTERESTED?

We encourage you to reach out, so we can schedule a time to chat .

More information on our data can be found here .

And the links below provide information on a variety of the solutions we provide:

To request a full-on demo, click here .