Who Should be Co-Branding Credit Cards with American Express, Discover, MasterCard, and VISA?

Who Should be Co-Branding Credit Cards with American Express, Discover, MasterCard, and VISA?

Co-branded cards are credit cards sponsored by two parties, typically issued jointly by a retailer and a financial institution. Both retailers and banks alike reap the benefits of these co-branded cards. Customers will spend more if their credit card is earning them discounts and special privileges. The retailer, thus, is rewarding loyal customers while also making more sales. Even beyond the partner store, these customers will spend more at other stores than they might otherwise have if they believe it will earn them discounts. The banks benefit from this higher spending because they get more revenue for processing the increased transactions.

In this article, we will reveal consumer brands the credit card companies ought to consider partnering with for future loyalty cards.

Looking at consumers of the four major credit card companies in the United States: American Express, Discover, Mastercard, and Visa, it might seem there are more similarities than differences. Understanding their core audiences through the lens of their social media behaviors unlocks a wealth of unique insights not readily available elsewhere.

If you are new to us, we are StatSocial . We are a social audience insight platform. We help brands, publishers, and agencies understand and target their audiences. We invite you to click HERE to check out our website. Please click around and explore some of our sample reports to get a sense of everything we can uncover.

Methodology: StatSocial identified hundreds of thousands of consumers of these four brands who follow their respective pages on social media and analyzed their social media presences to learn all that we could about them. We looked at their demographics, the brands to which they are most loyal, the celebrities and influencers they follow, and their personality traits, to name a few.

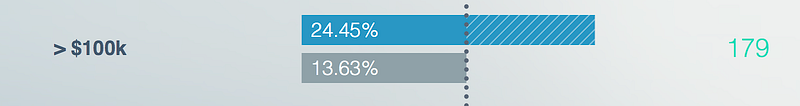

Before we get into the respective differences among the companies, there are many similarities among their users. All four cards are over indexed in the higher income brackets (> $100k, $50k-$100k) and under indexed in the lowest income bracket (<$50k). These users tend to look for bargains, are interested in technology and follow the news. In terms of food, they like fast food and drink Coke and Pepsi more than the average consumer but drink other sodas less than the average American. The consumers are slightly more likely to be men than women.

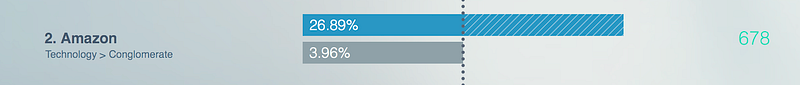

A Primer: Amazon’s Loyalty Card Insights

As you think about co-branded credit cards, Amazon’s card might come to mind. It currently has a partner card with VISA and Chase. When delving into our data, we see an interesting possible flaw with this decision. While 19.17% of VISA’s consumers exhibit an explicit interest in Amazon compared the 3.96% of the general US population, a whopping 26.89% of Discover’s followers are interested and engaged with Amazon. This may be an opportunity for Discover when Amazon is looking to the future. Along this line of thinking, below we explore other companies that might be a logical pairing for these financial institutions.

American Express

Airlines

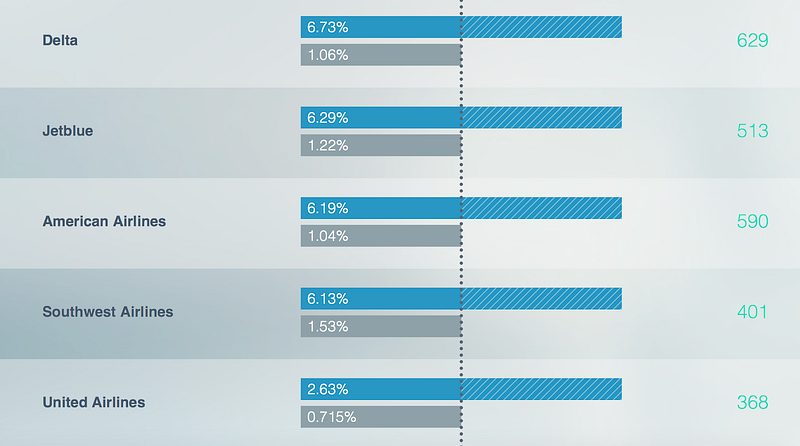

American Express stands out from the others in its consumers’ interest for all things travel. Its users show an affinity for travel that exceeds the average American netizen by almost two times and and an affinity for airlines by over four times. There is already a co-branded American Express Delta card, but this is an industry in which American Express could expand. While the other airlines may already have card partnerships, American Express would do well to approach them for future sponsorship. The graphs below show some companies with whom they might partner. Even adding more travel benefits to their card clearly would appeal to their audience.

Whole Foods Market Inc.

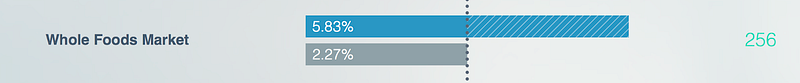

Whole Foods Market, the American supermarket chain that specializes in selling all natural and organic products, would be another lucrative partner. American Express consumers have over two and a half times the affinity for Whole Foods as the general American internet user. American Express’ over-index of the highest income bracket could help` explain the interest in the luxury grocery store. While American Express cardholders enjoy fast food, a lower percentage of its consumers do than the other credit card companies and instead many of its users are drawn to the organic Whole Foods. Amazon VISA gets 5% back at Whole Foods but a greater percentage of American Express users are consumers there. So perhaps a Whole Foods card could win more business from those customers.

Discover

Amazon

As we discussed earlier, Discover would do well to co-brand with Amazon. Discover cardholders have an affinity for Amazon that is almost seven times that of your habitual web goer. They could slip in when the partnership with VISA is up for renewal.

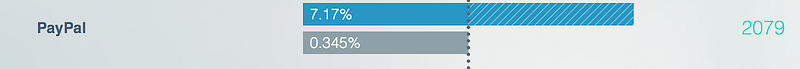

PayPal

MasterCard currently has a partnership with PayPal, but again there is an opportunity for Discover to jump in when the agreement is up for renewal. While 5.13% of MasterCard’s consumers have this affinity, 7.17% of Discover’s consumers have an affinity for the online payment. This is over 20 times that of general internet inhabitants.

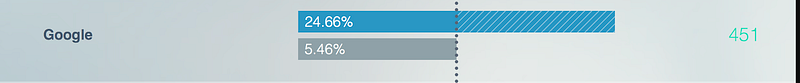

After finance, technology is a major interest for consumers of all four brands. They are drawn to conglomerates such as Amazon and Google. Google has GooglePay, but it does not have its own credit card. While GooglePay is a great online option, it could be beneficial to have a credit card to use for in person transactions. Of the four companies, the highest percentage of Discover cardholders show an alignment with Google. This interest is 4.51 times that of your typical netizen

Mastercard

National Basketball Association

Mastercard consumers show a extra strong interest in professional sports, especially baseball, basketball and football. Indeed, Mastercard already has a co-branded card with the MLB. An even higher percentage of its users are interested in the NBA. Although American Express already has a card with the NBA, Mastercard might be better suited take over that partnership. A significantly higher percentage of their users are interested in the NBA than those of American Express..

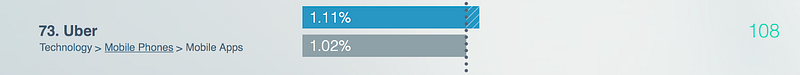

Uber

Uber currently has a credit card partnership with VISA, however, only 0.787% of VISA cardholders show interest in Uber which is actually lower than that of the average American internet users. Instead, Uber could switch to Mastercard where 1.11% of its users align themselves with Uber.

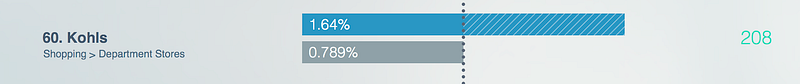

Kohl’s

Kohl’s is the largest department store chain in America by number of stores and the second largest by the number of retail sales. Currently, Kohl’s has a charge card; however, this card can only be used to shop at Kohl’s. Mastercard could create a co-branded card with Kohl’s, so its customers could use the card at both Kohl’s and other stores. Kohl’s is known for its steep discounts and good deals, so this card could offer even more promotions. Mastercard cardholders fall in StatSocial’s “Bargain Around Every Corner” cluster. This grouping means that these cardholders share a common ground of frugality. Affordability is a major selling point for this crowd, and they can be found couponing and searching for discounts. Kohl’s would be right up their alley.

VISA

McDonald’s (and other fast food chains)

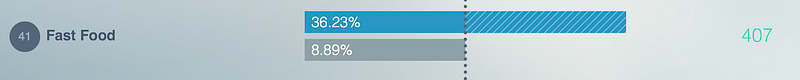

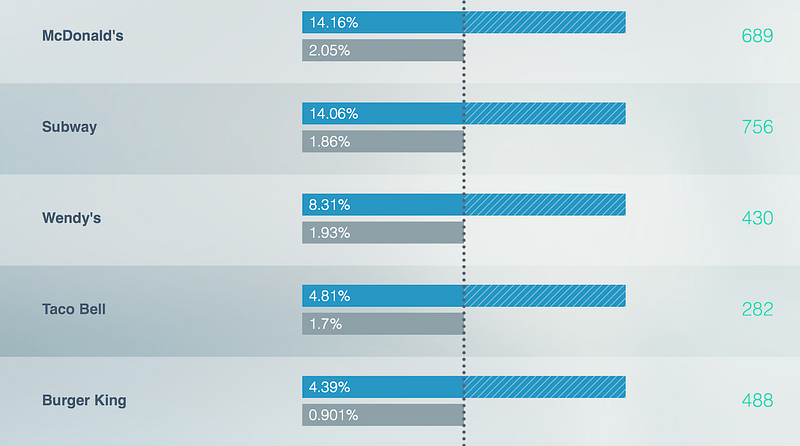

All four companies’ audiences show a stronger affinity for fast food than the general US population; however, VISA shows the strongest connection. VISA and McDonald’s go hand in hand in more ways than you might think. VISA holds the title of the largest credit card company to McDonald’s spot as the largest fast food chain. You can find a McDonald’s in all of the far corners of the world just as VISA is almost universally accepted. VISA consumers rank higher than average in StatSocial’s cluster, the “Food Court Cult.” In short, VISA card holders are fast food fans.

Taking this partnership a step further, VISA could capitalize on these cravings. They could partner with other fast food companies including Subway, Wendy’s and Burger King. Or instead of doing separate cards, VISA could do a joint card with several fast food companies or at least offer rewards for the additional fast food joints.

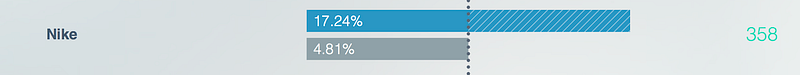

Nike

Here is an opportunity for VISA to dip its toe deeper into the fashion world. Nike is the top footwear company in the United States, but its reach goes far beyond shoes. Even the standout jersey of the World Cup, worn by Nigeria, was a product of Nike. Despite its team being knocked out early, this jersey was completely sold out and created quite the online buzz. Nike covers everything sports, which would be attractive to VISA cardholders. Not to mention that Nike’s trademarks of “Just Do It” and the swoosh logo are not easy to forget.

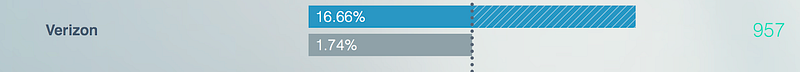

Verizon

Verizon, the largest telecom service provider in the United States, would be another interesting partnership. Among VISA cardholders almost 16.66%, ten times that of your typical American, show an affinity for Verizon. Verizon’s signal frequently tests as the most far-reaching and strongest. This widespread access and use would prove crucial as VISA cardholders tend to keep up with the news and like to be current in their techcentric worlds. Given the widespread increasing interest in technology and VISA’s audience’s strong affinity for telecommunications, Verizon would be an valuable partnership.

In Conclusion, One Caveat

As we wrap up, we must include a caveat. Looking at the credit card companies’ consumers, currently American Express has 58M cardholders, Discover 57M, Mastercard 191M, and VISA 323M. Thus, would it be better for a company like Amazon to stay with the brand that has more card holders or should it move to the brand with a higher percent of overlap? This is an interesting question that we cannot properly tackle in this article, but understanding the different credit card companies offer niche communities that attract different users has to be part of the equation.

Traditional market optimization focused on reach, not ROI. In the digital age, brands can optimize for sales/ROI in ways never before possible.

— —

Author: Kasey Stern