Which states are most engaged with online COVID-19 discussions?

Which states are most engaged with online COVID-19 discussions? And who is trending up/down? (Week 3)

We return to this blog today to share more insights reported by StatSocial ’s Crisis Insights service. This particular chart will be updated on a weekly basis, each Monday/Tuesday.

For those new to Crisis Insights : The subscription service has been built using StatSocial’s Silhouette ™ social data platform. The service is a tool for brands, marketers, and agencies seeking to understand the rapidly changing dynamics of their customers who, as a result of the uncertainty born of the COVID-19 pandemic, are finding their customer dynamics shifting during these trying times.

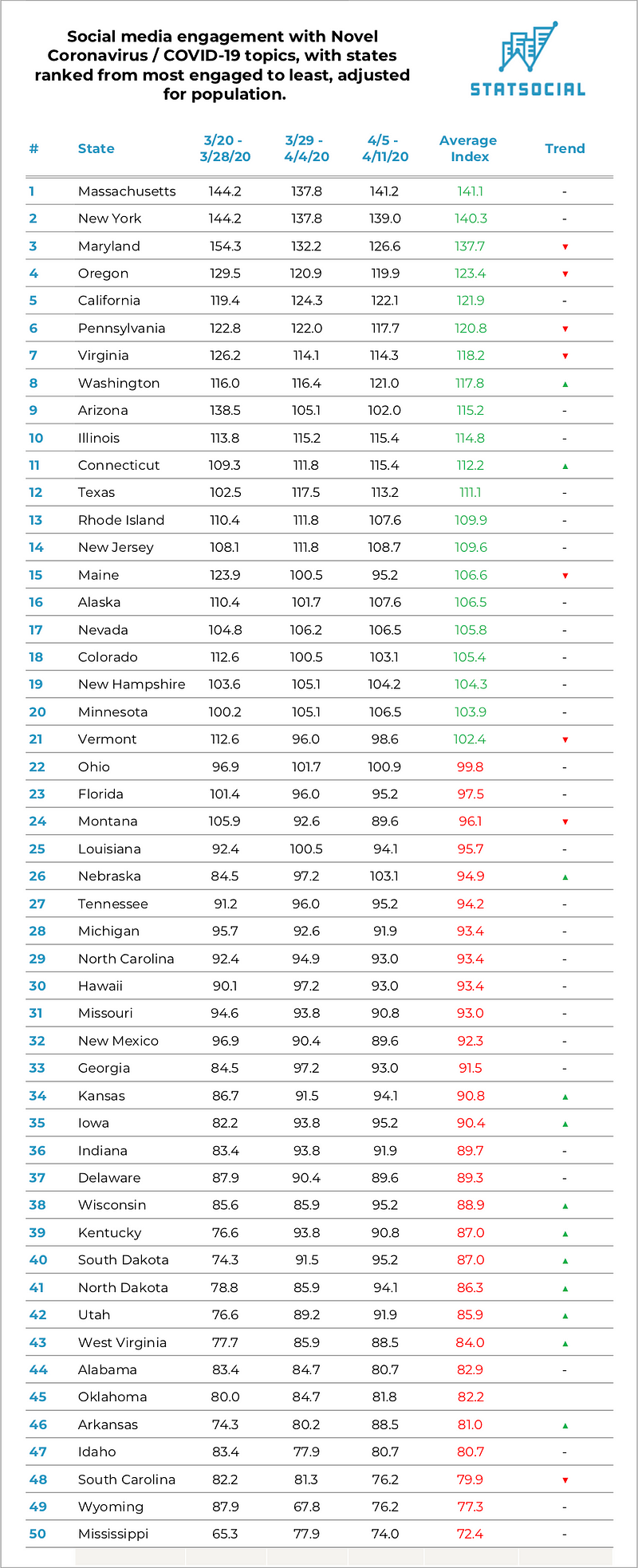

The 50 United States, ranked by online engagement with Novel Coronavirus / COVID-19 topics, from most engaged to least

Explanation of the above data: The scores on the above chart are index scores. Used for convenience here, these scores summarize, at-a-glance, the degrees to which social media content related to novel coronavirus / COVID-19 topics have been engaged with by the residents of each state.

The index scores are calculated based on contrasting the above described statistics with the entire United States population’s engagement with novel coronavirus / COVID-19 topics. A level score of 100 is used to represent this national number, and the scores on the above graphic report the degrees to which each state’s engagement is in excess of or is equal to (represented in green), or falls short of (represented in red) that baseline.

Each state’s engagement has been broken out by week (the first three to have transpired since Crisis Insights ’ launch). This allows you to see how engagement has increased, decreased, or held steady week-to-week.

The data used for Crisis Insights ’ reporting is collected and analyzed daily, and then reported to subscribers as rolling seven and 30-day averages (as well as a full data series).

In addition to the insights shared here — regarding where each state’s residents stand when it comes to engagement with topics surrounding the COVID-19 matter — this also offers a small glimpse into how our constantly revised, amended, and well-presented reporting allows brands to observe, compare, and retain context for customer behaviors, concerns, affinities, etc., as they shift, change, and are even replaced over the coming weeks and months.

Massachusetts is the top ranked state here, with its citizens’ engagement with online COVID-19 coverage exceeding the baseline by 1.41 times. The state’s week of highest engagement, to date, has been the week of March 22 to March 28. The week of March 29 to April 4 has, thus far, seen the lowest engagement from the state’s residents.

As of this writing, the state has been home to the third highest number of diagnosed cases, and the fifth highest number of confirmed deaths from the virus.

At the other end of the spectrum is Mississippi, which has thus far seen the 28th highest number of diagnosed cases. It has experienced the 26th highest number of confirmed fatalities resulting from the virus.

The state’s week of lowest engagement, to date, has been the week of March 22 to March 28. The week of March 29 to April 4 has, thus far, seen the greatest engagement from the state’s residents.

Finally, for now, of very real note is the upward trend in engagement detectable among many states currently found in lower half (mid-30s to high-40s). Kansas, Iowa, Wisconsin, Kentucky, the Dakotas, Utah, West Virginia, and Arkansas have all found their residents engaging with COVID-19 content to an increasing extent.

We eagerly invite you to visit our Crisis Insights page here , and to reach out to us to learn a great deal more about the service, and to check out a demo.

As before, and as always, we sincerely hope that all reading are doing as well as circumstances allow, and are safe.

What are Crisis Insights?

Crisis Insights provides subscribers with near real-time updates on how the unprecedented climate in which we all find ourselves is affecting consumer sentiment, both among the general public, as well as a brand’s specific customers.

Changes in consumer sentiment are tracked in this reporting, for 32 crisis-related segments, across four general categories:

- People concerned about the Covid-19 epidemic

- People concerned about the direction of the economy

- People coping and adjusting to the ‘new normal’ environment

- General attitudes and psychographic outlook of the population.

We encourage you to visit these previously shared Crisis Insights related posts:

We took a look at the personalities of those most actively engaged with COVID-19 content online:

We’ve been using this blog as a space for highlighting insights generated by StatSocial’s new Crisis Insights service. blog.statsocial.com

Here we examined the preferred TV genres of those most active in the online COVID-19 discussion:

This week we’ve been posting insights generated by StatSocial’s new Crisis Insights service. blog.statsocial.com

Here we took a look at some top-line demographic and geographic data regarding those most actively engaged in the online, COVID-19 discussion:

StatSocial is tracking the day-to-day composition of online audiences engaging with all Novel Coronavirus Covid-19… blog.statsocial.com

And here is the entry wherein we announced and introduced Crisis Insights: